what to do if i cant pay my bills

six Min Read | Sep 24, 2021

At first, the credit card payments didn't seem like a big bargain. A few bucks here, a few bucks there. You didn't pay attention to the involvement or the balance. That is, until you lot added up the other bills: Student loan payments. An unexpected trip to the emergency room. A new roof. Before you know it, y'all're out of coin and sitting on pinnacle of a mount of debt. Merely there are still bills to pay and not enough money to cover them.

So what do you practise when y'all can't pay your bills?

i. Cover your Four Walls.

When creditors are calling (emailing, texting, or sending snail post), it's easy to become bullied. Most of the fourth dimension, they'll try to convince you that paying them is more of import than keeping the lights on.

Mind closely: The near important thing you can practice is take care of your Four Walls showtime—and in this order:

- Food

- Utilities

- Shelter

- Transportation

Before yous spend even 1 more dime toward debt, make sure to take care of you lot and your family. That means y'all need food in the fridge, lights and running water, a roof over your head, and a manner to get to and from work every day.

two. Go on a upkeep.

We know, you're probably thinking, What's the point of a budget when I take no money?

You lot can pay off debt faster! Get started with a FREE trial of Ramsey+.

Give us the benefit of the dubiety hither. When you make a budget, you're taking inventory of the money you have coming in and telling it exactly where to become. This is extremely helpful when you're wondering how to brand ends encounter.

With a zero-based budget and more than debt than income, you might see a lot of red for a little while. But don't worry. Stick to your budget, cut out the extra spending, and you'll see it residuum to that beautiful zero in no time.

3. Get (and stay) current on your bills.

That means you need some extra cash—and fast! Whether that means you become a second or third task, start a side hustle making cupcakes, or sell that fancy wedding china yous've never taken out of the box.

Don't worry—there'southward plenty of things you can practise to brand ends meet:

- Sell your vehicle for a cheap-but-reliable used auto instead.

- Accept the biggest yard auctionever.

- Don't step foot within of a restaurant unless you work there.

- Get a 2nd job.

- Consider downsizing your home so y'all can brand more manageable payments.

- Switch your cell phone plan to a pay-equally-you-become service—and use your phone only for emergencies.

- Get a roommate and share the living expenses.

- And no matter if it's $v or $500, whatsoever extra coin you make should go toward past-due bills.

You lot always take options!

4. Give your creditors their fair share.

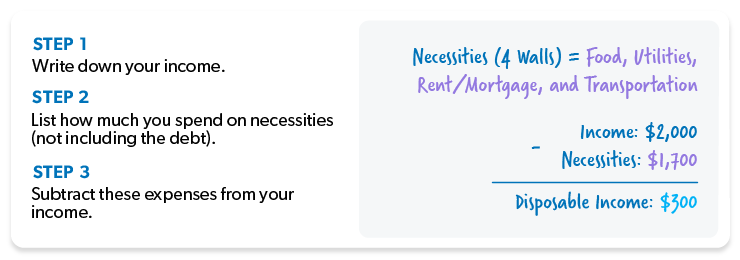

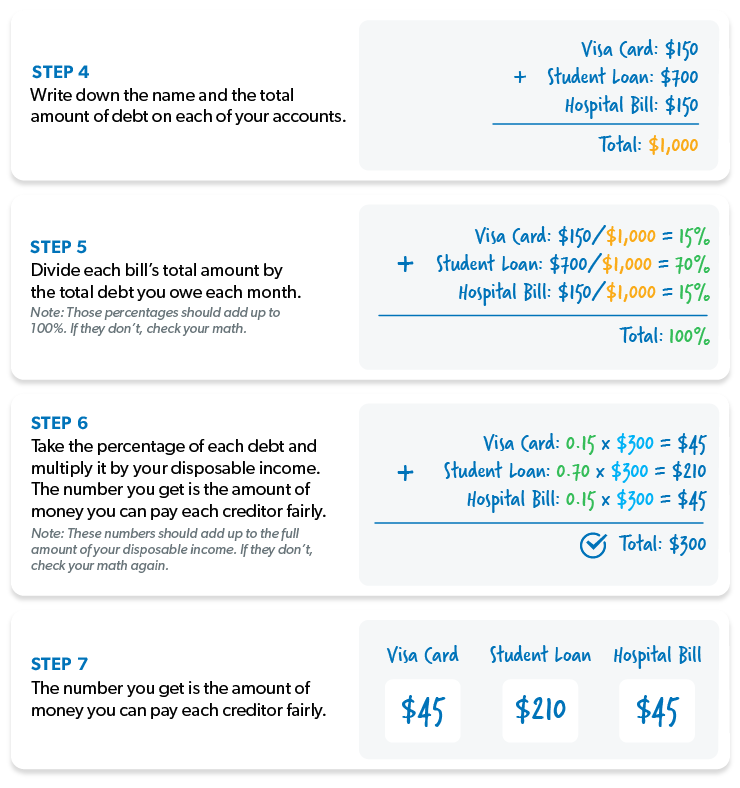

When you can't pay your bills, you need a plan. And when information technology comes to dealing with creditors, nosotros like to utilize what's called "pro rata" . . . or "off-white share." This means yous'll give each of your creditors their fair share of the coin you accept left later on yous've paid for the essentials (like the Four Walls). Here's an example of how it works:

In this case, y'all have $300 left over to pay your creditors. This is yourdisposable income.

One time yous know how much money you tin spend on debt payments, you need to figure out pro rata. This function is a little more complicated, but stay with us. Here'due south how yous calculate information technology:

Remember, thepro rata program is but a short-term solution. Information technology but gives you enough breathing room to make changesfor the better.

But hither'south the thing: You won't exit of debt this way. However, making monthly payments to each creditor goes a long way in the long run.

5. Ship payments with a letter.

Now that you've decided who to pay (and how much to pay them), it's time to transport your payments. Make copies of your math, including your income, expenses, disposable income, and the calculations you fabricated to give every creditor their off-white share. Don't forget to include this letter of the alphabet with every bill, every single month.

Those creditors won't similar getting less than the minimum payment, but if you go on sending checks every calendar month, they'll probably keep cashing them.

This doesn't mean they'll terminate calling and bullying you into giving them more than money, but don't let that steer you off course. You don't desire to get so rattled that you agree to something that will shoot yous and your family in the foot when it'southward time to purchase groceries.

Andnever, ever give a creditor access to your bank account for automated withdrawal every month. They'll clean you out—even if they say they won't.

At present What?

It'due south time to move away from that paralyzing fright and start getting mad. Listen: Debt has got you lot chained to your past, so information technology's fourth dimension to outset attacking information technology with everything yous've got.

Give your debt the boot in the pants it needs to become out—and stay out—of your life. How? By changing your behavior (and your attitude). We're guessing that by at present, y'all're sick and tired of living paycheck to paycheck.

That's where the debt snowball comes in handy:

Step 1: List your debts smallest to largest, regardless of interest rate. Pay minimum payments on everything but the little one.

Step 2: Assail the smallest debt with a vengeance. One time that debt is gone, accept that payment (and any extra coin you can squeeze out of the budget) and apply it to the second-smallest debt while continuing to brand minimum payments on the residuum.

Pace 3: Once that debt is gone, take its payment, and apply it to the next-smallest debt. The more yous pay off, the more your freed-upwardly money grows and gets thrown onto the next debt—like a snowball rolling downhill.

Repeat this method every bit you turn your way through debt. Pretty soon, you'll exist debt-free and set up to start living the life debt stole from yous.

Remember: You don't ever want to go at that place again, and then do any information technology takes to say hasta la vista to debt for good! Just imagine the life yous'll exist living when you're debt free.

Gear up to take a deeper dive? Check out Dave Ramsey's bestselling book The Full Coin Makeover. This book will help you become to the middle of your money problems and show you vii practical steps that will atomic number 82 y'all out of debt and into a real-life total money makeover.

About the author

Ramsey Solutions

Source: https://www.ramseysolutions.com/debt/what-to-do-when-you-cant-pay-your-bills

0 Response to "what to do if i cant pay my bills"

Post a Comment